Overseas Adventures: Resources for Retiring Outside the U.S.

Featured Resources

The Expatsi Test: Discover Which Country Is Best For You

Take this free test to discover what countries you should move to based on the weather, cost of living, government, education, healthcare, and many other factors.

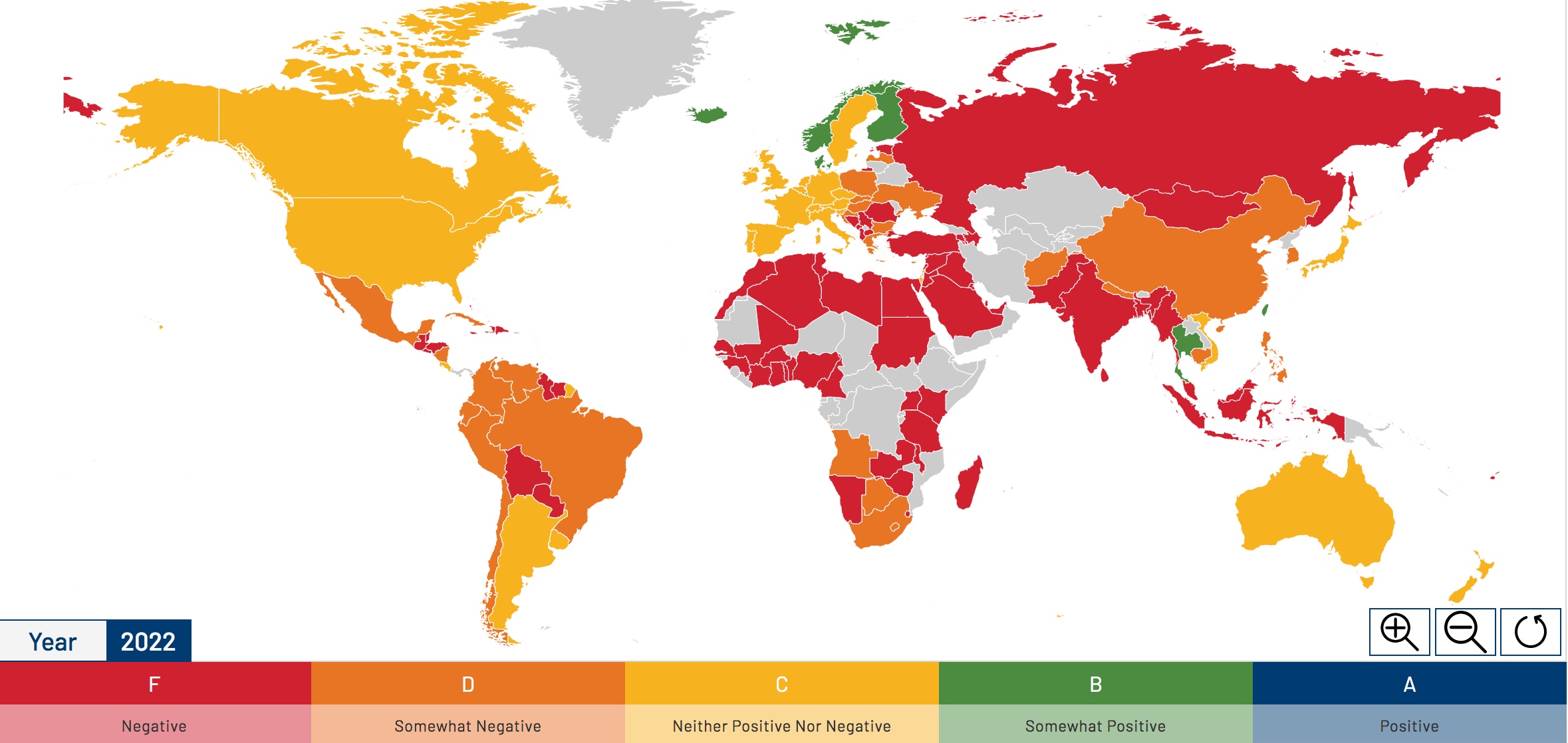

How Does Each Country Rate for LGBTQ+ Rights?

The F&M Global Barometers LGBTQI+ Perception Index shows potential differences between existing legislation and the actual human rights climate in countries.

Why Retiring Outside the U.S. Is On The Rise

There has been a dramatic increase in clients asking this question due to the recent U.S. Presidential election results. Some people don't know where to start or understand what they need to make their wishes a reality.

Take Control in a Time of Uncertainty

Here's how to take a break to reflect and realign yourself to put things in better perspective so you are making objective decisions based on what’s best for you and your future.

Where should I move?

International Living: The World's Best Places to Retire in 2024

At International Living, we firmly believe that you don’t have to be wealthy and well-connected to lead a more international life. You just have to know how to do it. And we’re on a mission to show you. Since 1979, we’ve been helping people live, retire, travel, invest, and prosper overseas.

Greenback Expat Tax Services: Top 13 Tax-Free Retirement Countries for Americans Abroad

In this guide, we have compiled a list of top countries that offer an ideal combination of these elements, catering specifically to the needs and preferences of American retirees who are interested in international living. From affordability and healthcare infrastructure to cultural richness and expatriate communities, each country on our list has been evaluated to ensure it offers a high quality of life and a welcoming environment for those looking to make the most of their retirement years.

How do I plan and pay for it?

Expatsi: How to Move Abroad

There's no one way to move abroad, but expats all have the make some of the same choices (where, when, how) and take many of the same steps (find insurance, housing, movers). We think there are six stages to emigrating out of the U.S., and they're not perfectly linear.

Global Intelligence Unit: Retirement Guide For U.S. Citizens

This comprehensive guide integrates public data, academic research, expert opinions, and industry insights to identify the top 16 countries favored by American retirees, based on factors like quality of life, integration ease, community acceptance, security, and economic conditions.

Forbes: Retire Abroad? Here’s What You Need To Consider First

Forbes identified 24 top countries to retire abroad by weighing everything from living costs and amenities to medical care to ease of getting permission to stay. Here’s how to do your own research.

Gaycities: How easy is it for Americans to move to another country?

Donald Trump has won the American presidential election. If you’re okay with that, this article isn’t for you. But if you’re an American and you find this prospect terrifying — if you thought Trump’s first term as president was a horror show, and you have a strong sense that a second time around, things would be much, much worse — then you might be looking for, uh, life-alternatives for 2025 and beyond.

What about taxes, benefits, and healthcare?

IRS: Tax Guide for U.S. Citizens and Resident Aliens Abroad

If you are a U.S. citizen or resident alien, your worldwide income is generally subject to U.S. income tax, regardless of where you are living. Also, you are subject to the same income tax filing requirements that apply to U.S. citizens or resident aliens living in the United States. Expatriation tax provisions apply to U.S. citizens who have renounced their citizenship and long-term residents who have ended their residency.

Getting Social Security benefits if you are living outside the U.S.

Most U.S. citizens can get Social Security benefits while visiting or living outside the U.S. Find out if you qualify, how to apply, and who to contact to get help.

Medicare coverage when living abroad

Decisions about Medicare enrollment can be complicated if you live outside the United States. Living outside the U.S. means you do not live in the 50 states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam, American Samoa, or the Northern Mariana Islands. Although Medicare does not typically cover medical costs you receive when you live abroad, you still need to choose whether to enroll in Medicare when you become eligible or to turn down enrollment.

Health Insurance for American Expats

If you’re an American expat living in a foreign country or you are just now starting your new life as an expatriate, you need to understand the importance of international health insurance while living abroad.

The Ultimate Moving Abroad Planner, by Amy Beth Miller

Living overseas can be one of the most rewarding experiences of your life and one of the most challenging. What you see, hear, learn, and experience will forever change you.

But first things first—you have to get there.

If only it were just a matter of purchasing a plane ticket, packing a suitcase, and arriving at your new destination! While there may be a lucky few who can make the transition to life abroad that simply, for the vast majority of people, there are many logistics and details to consider.

There are a variety of categories and checklists in this planner. Depending on how much you like lists, the volume of pages may feel overwhelming or may be comforting. Either way, this planner is designed to help you find peace of mind as you prepare for your move abroad.

Depending on your destination and life situation (whether or not you have kids, pets, an employer, etc.), you may find all of the pages relevant and useful, or perhaps only a portion of them will pertain to your circumstances.

Some of the checklists have been started for you to give you a jump on getting organized. However, not all of the items may be required for you to complete. Many of the checklists have blank spaces so that you can customize this planner to your specific situation.

This planner will help you be better prepared!